UHERO, the University of Hawaii Economic Research Organization, says the State, which will have a significant shortfall in revenue plus increases in expenditures because of COVID-19, has to look at several options to restore fiscal balance. The State continues to receive Federal funds to assist, but UHERO says there will still be significant budget challenges. At its May 28 meeting, the State Council on Revenue cut its general fund tax revenue forecast for FY2020-FY2026 by almost $10 billion. For the rest of this fiscal year and the next, a $2.3 Billion shortfall is predicted.

The authors of the post are James Mak, Robert D. Ebel, and Carl Bonham (attached photo is Bonham). Bonham gives regular updates to the State House Select Committee on COVID-19 about the economy, unemployment, jobs, and more.

The authors say there are several options for addressing the budget gap. The first would be for Congress to provide more federal aid for state and local governments.

Next to more federal aid, responsibly re-opening businesses (including tourism) would begin to restore the state’s fiscal balance. Without substantial tourism recovery—which accounts for 30 to 35 percent of state tax revenues (pre-COVID-19)15—it will be impossible to overcome the current fiscal crisis.

It has been suggested that economic diversification can be a solution to our current economic crisis, but the authors say it cannot. An economy’s industrial structure tends to change very slowly. It took decades for Hawaii to diversify into tourism from sugar and pineapple production.

During the Great Recession some states enacted tax incentives, giving some businesses tax breaks, to spur economic recovery. The authors say that most tax incentives are ineffective at spurring economic recovery, and they also reduce tax revenues at a time when the tax revenues are already in a decline.

Borrowing to pay for the day-to-day bills of the state government is not a realistic solution except for short-term exigencies.

The authors also note that the State can get Federal loans (which State House Speaker Scott Saiki has supported), shift monies out of special funds, and give no or less money to the counties from the Transient Accommodation Tax. The latter move would further stress the county budgets, which are facing the same fiscal challenges.

The State can also reduce the cost of government, i.e. spend less. The authors refer to a May 11, 2020 article in Governing by Stephen Goldsmith of Harvard Kennedy School and Charles “Skip” Stitt of Faegre Drinker Consulting, saying there are ways government can cut costs and maintain services by improving efficiency. Goldsmith and Stitt say “the current situation, coupled with new technology tools, provides governments with a once-in-a-century opportunity to change many of their outdated procedures permanently — to build strategic fiscal management into their operations and cultures.”

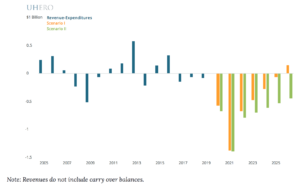

UHERO’s report includes a graphic, with the past fiscal situation and the future possible fiscal scenarios, based on a range of situations: